Advanced Micro Devices this week reported its financial results for the second quarter of 2014. The company did not manage to take advantage of corporate PC replacements, like its rival Intel did, but sales of chips for video game consoles allowed the firm to post rather significant increase in revenue compared to the same quarter a year ago. Unfortunately, just like in the Q1 of 2014, AMD could not make any money and even extended its losses in Q2 2014.

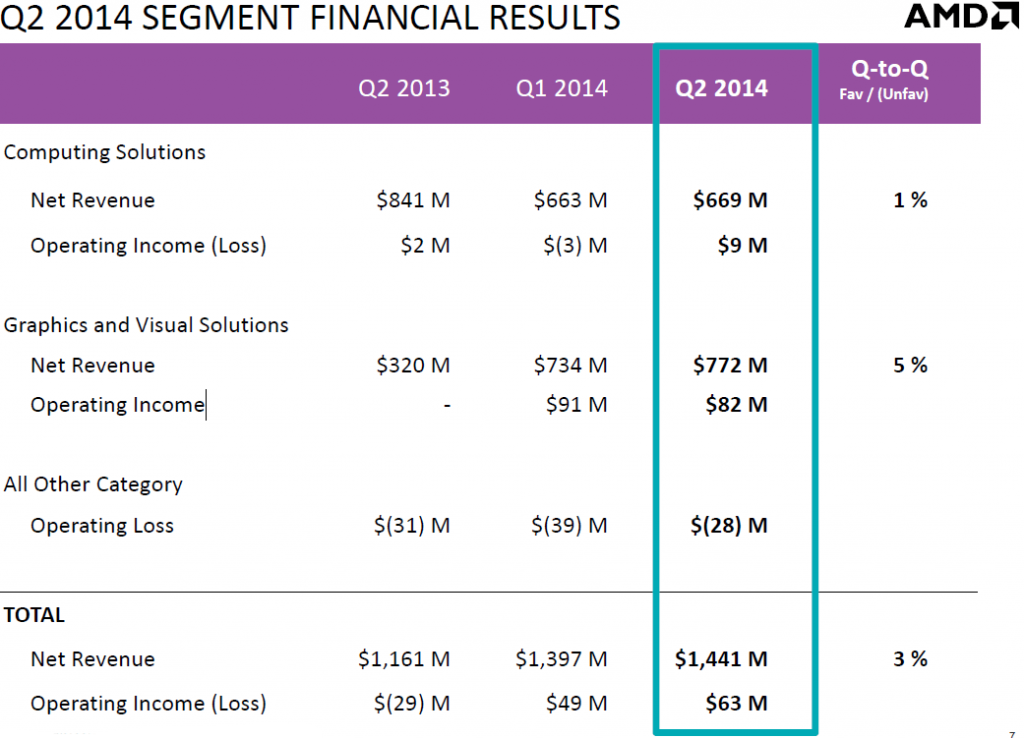

For the second quarter of 2014 the Sunnyvale, California-based chip designer reported revenue of $1.44 billion, an increase of 3 per cent sequentially and a massive upsurge of 24 per cent year-over-year. AMD reported operating income of $63 million and net loss of $36 million, or $0.05 per share. AMD lost money in the Q2 2014 because of $49 million of loss from debt redemption in the quarter. The company’s gross-margin remained at 35 per cent, which is below gross margin of its direct rivals, Intel Corp. and Nvidia Corp.

AMD’s computing solutions segment (CSS) revenue was $669 million, an increase of 1 per cent sequentially and a decrease of 20 per cent year-over-year (YoY). AMD’s CSS division earned $9 million in profit during the quarter. The company said that in the Q2 2014 sales of its platforms for notebooks increased, whereas shipments of its desktop platforms decreased. Thanks to higher amount of mobile chips in AMD’s product mix, microprocessor average selling prices (ASPs) increased sequentially and year-over-year. The company blames lower sales of desktop parts for its massive YoY CSS revenue decline.

AMD’s graphics and visual solutions (GVS) division earned $772 million in revenue, an increase of 5 per cent sequentially and 141 per cent year-over-year. The unit’s profit for the quarter was $82 million compared with $91 million in Q1 2014 and breakeven in Q2 2013. The reason for the incredibly high YoY increase is the fact that AMD GVS now ships semi-custom system-on-chips that power Microsoft Xbox One and Sony PlayStation4 video game consoles. Last year the company simply did not ship them in the second quarter. Because significantly lower sales of graphics cards in the channel, the company said its GPU revenue was down both sequentially and compared to the same period a year ago. Average sales prices of graphics processors also decreased during the quarter despite of increased sales of professional graphics cards.

Even though the company manages to increase its revenue thanks to sales of semi-custom SoCs, it looks like it does not receive a lot of profits from such chips. In the first quarter of the year AMD lost $20 million, in the second quarter the losses increased to $36 million.

While the semi-custom business seems to be very attractive, the company still needs the market of personal computers to be profitable. In order to win the PC market, AMD needs to sell competitive microprocessors and graphics processing units. While the latter are on par with competing solutions from Nvidia, the former are considerably behind processors from Intel.

For the third quarter of 2014, AMD expects revenue to increase by around 2 per cent sequentially.

Discuss on our Facebook page, HERE.

KitGuru Says: While the plan to sell semi-custom SoCs to large companies like Microsoft and Sony certainly pays off, it is noteworthy that shipments of lucrative central processing units/accelerated processing units and graphics processing units have been declining for several quarters now. Without competitive micro-processing and graphics processing technologies AMD will be unable to design competitive semi-custom chips for large clients eventually. At the end, AMD still need to be serious about its core x86 and graphics businesses.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

Wonder what the hell are they gonna do now…

What did they expected?

They had a beautiful line of 7700 cards like 7770, 7750 and 7730 priced just fine and performing better than anything Nvidia could offer. Then they thought that it would be a good idea to replace 7770 with a mediocre R7 250 AT THE SAME PRICE AS 7770, eliminate 7750 and replace 7730 again with a worst performing R7 240 AT THE SAME PRICE AS 7730.

Then we have Kaveri. They decided to send for review the most interesting part, the A8-7600 alongside 7700K and 7850K and then they HIDE IT UNDER THE COVERS. I was waiting for 3 months to buy that processor. I stopped waiting. I ABANDONED the transition from AM3 to FM2+ COMPLETELY. It was the first time in 15 years that I was thinking going Intel. How many DID go Intel?

THEY ARE MORONS.