Although only a quarter of the size of Intel in terms of overall chip production, Korean memory specialist SK hynix is number two in the memory module business – ahead of companies like Toshiba. As the overall market continues to recover and SK hynix begins to flex its own marketing muscle, there seem to be even bigger changes afoot for 2015.

Technology enthusiasts, and those working inside this market, have been familiar with the SK hynix brand for a number of years. Originally founded in 1983, it now boasts an annual turnover that is around 3x larger than AMD, with close to 17,000 employees worldwide.

The vast majority of its income is derived from B2B (business to business) – in other words, selling memory as a component to companies that make memory modules, smartphones, tablets, PCs etc.

But with the more recent launch of SK hynix branded consumer products like Solid State Drives, the potential for this brand in 2015/16 is enormous.

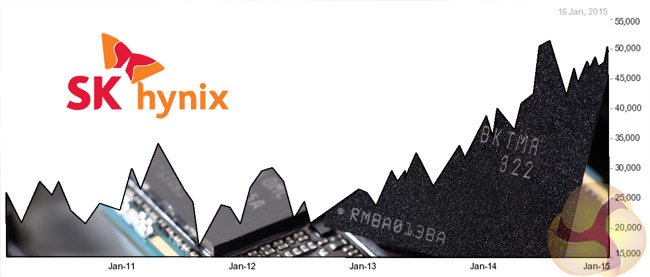

SK hynix share prices peaked at just over $46 last week, which peaked up close to a 52-week high, and represents a significant increase in the value of the company over the whole year.

According to specialist news agencies in the Far East, the buoyancy in SK hynix's share price is set to continue as more and more foreign investors take interest in this Korean manufacturer.

KitGuru says: If you're supplying memory for MacBooks as well as Nexus products and even the EeePC – as well as your own memory devices – then 2015/16 is likely to be a very healthy period in your company's trading history. Probably.

Just how big can a company like SK hynix grow? Let us know over on Facebook.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards