Intel Corp. is negotiating with Altera Corp., a developer of system-on-chips, field programmable gate arrays and other specialty devices, over a possible takeover. The acquisition could strengthen Intel’s positions across many markets. The transaction could top $10 billion, which will be Intel’s biggest purchase ever.

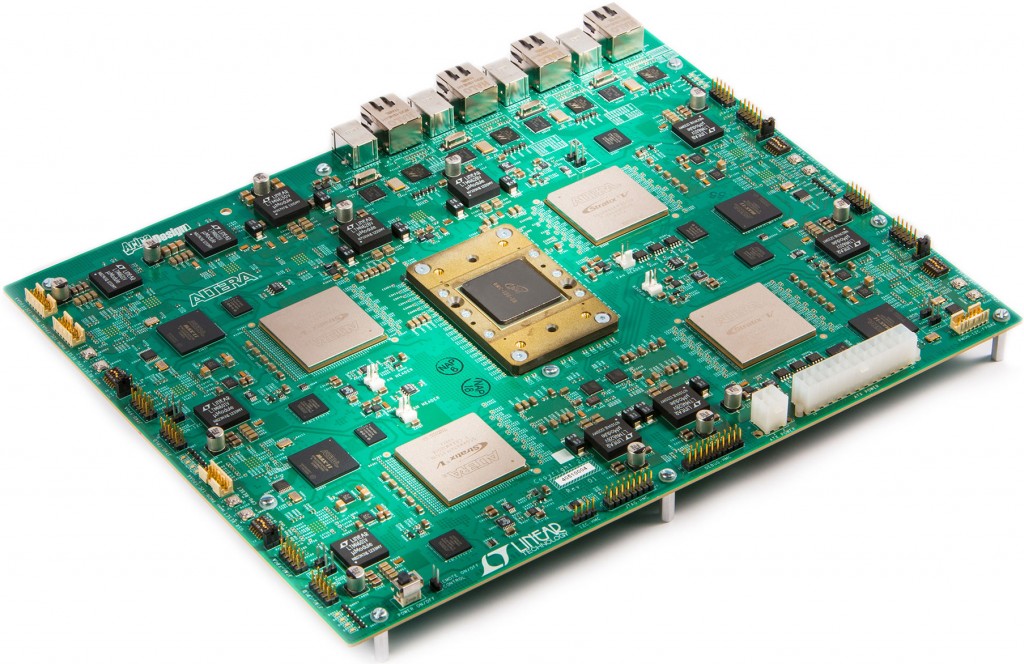

Altera develops and sells field programmable gate arrays (FPGAs), complex programmable logic devices (CPLDs), system-on-chips (SoCs) and processors used in automotive, industrial, medical, military, telecommunication, storage, high-performance computing and other industries with special requirements. Altera not only sells chips, it provides software tools, intellectual property (IP) cores, development kits, reference designs, and software development kits (SDKs) targeted for various industry applications. Intel integrates Altera’s FPGAs into select HPC platforms or even installs them on-package with custom Xeon processors for certain clients.

Altera’s net sales in 2014 were $1.932 billion, gross margin of the company was 66.4 per cent and net income was $472.65 million. The company spent $418.17 million, or 21 per cent of revenue, on research and development (R&D). The company spends hundreds of millions of dollars on production of chips at Intel Custom Foundry and Taiwan Semiconductor Manufacturing Co.

Intel, which has a market capitalization of over $150 billion today, sells microprocessors and supporting chips for personal computers, servers and ultra-mobile devices. The acquisition of Altera will help Intel to greatly diversify its business without affecting profit margins. The Wall Street Journal reports that Intel Corp. is in advanced talks to buy chip partner Altera, which means that the deal could be announced shortly from now.

“On the surface, Altera is one of the only semiconductor companies with better gross margins than Intel, and with about two-thirds of its revenue from telecom, wireless, military/aerospace, it definitely fits the bill of diversifying revenue beyond Intel’s legacy computer markets,” said Timothy Arcuri, an analyst with Cowen & Co.

Acquiring Altera would further solidify manufacturing partnership between the two companies, which will help Intel keep its factories utilized. Eventually, Intel could integrate FPGA and CPLD capabilities into its Xeon chips to let end-users add certain capabilities after the processors are manufactured.

Customization of central processing units and platforms will help Intel to better compete against multiple developers of server-class system-on-chips based on ARM architecture. It will also help it to eventually compete against OpenPower server consortium led by IBM.

If Intel buys Altera, it will be the largest acquisition in its history, Reuters news-agency notes. It would easily surpass Intel's previous biggest deal, its $7.7 billion purchase of security software maker McAfee in 2011.

While Intel would make gains by acquiring Altera, actual benefits that Altera would from the takeover in the short- to mid-term future are not evident. Moreover, because Intel altered its 14nm manufacturing process, it delayed tape outs at Intel Custom Foundry, which negatively affected the company’s customers, including Altera. Chris Danely, an analyst with Citigroup, believes that Altera should use foundry services of Taiwan Semiconductor Manufacturing Co., which will give it numerous competitive advantages.

“We believe such an acquisition would be negative for Altera’s business given the Intel’s recent execution issues with its foundry,” wrote Mr. Danely in a note to clients, reports Tech Trader Daily. “We believe Altera would be better served by going back to Taiwan Semiconductor (TSMC) for 10nm foundry. However, if the company stays with Intel foundry we believe delays will continue in the near term until Intel better manages its foundry business. As we discussed in our March 2 note, ‘More Delays for Altera…’ our checks indicate Altera’s 14nm tape out at Intel has been pushed out from 2Q15 to 2H15.”

Intel and Altera did not comment on the news-story.

Discuss on our Facebook page, HERE.

KitGuru Says: While Intel can definitely afford acquisition of Altera and could gain huge benefits of it, the big question is whether the latter needs to be taken over. At present Altera has only one rival, Xilinx; its margins are very high; its relationship with Intel already gives it access to leading-edge process technologies; whereas collaboration with various chip vendors (Intel, IBM, etc.) lets Altera target many different markets.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards