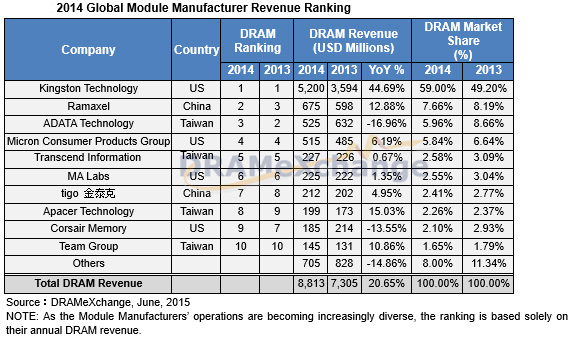

The year 2014 was very favourable for producers of dynamic random access memory as well as for makers of various DRAM modules thanks to rather high prices and stable demand for personal computers and other devices. Kingston Technology remained the top producer of memory modules on the planet with nearly 60 per cent market share.

Global sales of DRAM modules last year totaled $8.8 billion, according to DRAMeXchange, a division of TrendForce and the world’s top memory market tracker. DRAM revenue in 2014 increased by whopping 21 per cent year-over-year. Market growth was primarily conditioned by stable prices as well as the rise of contract transactions relative to spot trades. According to analysts, average selling price of a 4Gb DDR3 memory chip was $3.65 in 2014, a 18 per cent increase over the ASP a year before. The spot market for 2014 had also been strong with the average price of a 4Gb DDR3 IC hanging around $4, a 17 per cent increase compared to 2013.

The top five module makers remained dominant and accounted for 81 per cent of the 2014 gross sales. Moreover, the top ten companies made up 92 per cent of the market revenue for that year.

- Kingston retained its No. 1 position with 59 per cent revenue share, it took full advantage of increasing contract trades and stable prices, according to DRAMeXchange. Kingston managed to increase sales of DRAM modules by rather whopping 44.69 per cent last year.

- Ramaxel, which supplies modules to Lenovo Group, followed Kingston at No. 2. The company posted a 13 per cent annual revenue growth.

- Adata last year slightly changed its strategy and reduced the share of DRAM in its product mix, which is why it dropped to the third position in the global rankings of memory module suppliers.

- Micron Consumer Products Group, which sells products under Crucial and Micron brands, retained its fourth place last year and increased its sales by 6.2 per cent.

- Transcend could not take advantage of the market situation and did not increase its sales of DRAM modules in 2014. The company focused on improving profitability and concentrated on industrial memory products. It was the No. 5 supplier of memory modules on the planet last year.

DRAMeXchange believes that with the DRAM spot market shrinking this year, module manufacturers should consider new markets to sustain their revenue growth. Analysts believe that makers of memory modules need to better address the market of industrial and gaming applications.

Discuss on our Facebook page, HERE.

KitGuru Says: In general, the market of memory modules seems to be pretty stable. Given the sizes of top 10 producers of modules, it is unlikely that any newcomers will be able to challenge them. It will be very interesting to see whether to improve their buying power and volume of scale any leading producers of modules will eventually decide to merge.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

Surprised-G Skill is very popular with home builders,yet don’t even get in the top ten……………

Just what I thought. No G-Skill !!!