Intel’s Q1 financial results just about managed to top analyst expectations, but that hasn’t stopped the company from lowering its annual revenue estimation. This forecasts Intel’s first year-on-year revenue decline since 2015, which has subsequently caused its stock to plummet 7%.

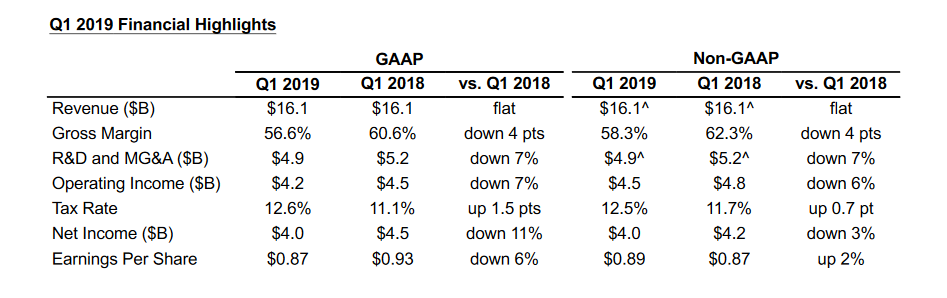

Bob Swan’s first quarterly earnings report since stepping up as Intel’s permanent CEO managed to outdo analyst predictions of $16.02 billion in Q1, instead bringing home $16.06 billion. This number is flat in comparison to 2018’s first quarter, but saw a drop in operating income from $4.5bn to $4.2bn, net income fall from $4.5bn to $4.0bn and gross margins decline 4% year-on-year.

It isn’t all doom and gloom for Intel, as its Client Computing Group managed to show growth. The company’s PC-centric business managed to see an increase in revenue despite volumes in the notebook and desktop market falling 7% and 8% respectively, all thanks to higher average selling prices. In particular, this helped strengthen growth in its gaming, commercial and modem markets. Its cloud segment also grew 5% and Internet of Things continued to bolster by 8% with revenue soaring to $910 million.

Enterprise and government revenue haven’t been so lucky, seeing the firm’s steepest decline of 21% during the quarter, while communications declined 4%. Unfortunately, with Intel bowing out of the 5G smartphone market citing “no clear path to profitability,” the company is more reliant on its dominance in data centre business than ever, which, in itself, is in decline. The arm fell 5% year-over-year in the first quarter, with reported revenue of $4.9bn down from $5.2bn the previous year.

Intel stated that it is currently “conducting a strategic assessment of 5G modems for the PC and IoT sectors,” but its current lack of diversification is worrying. In response to the recent news, the company had no choice but to lower its full year revenue expectations, dropping from $71.05bn to $69.0bn. This would be a year-on-year decline from $70.8 billion in 2018, which has sent stock spiralling.

Looking ahead to the second quarter, Intel is hoping to accumulate $15.6 billion with an operating margin of 27%. The performance of this quarter will cement whether the company is sure to make its first loss in four years.

KitGuru Says: 10nm desktop processors sure would help right about now, as the 14nm process is strained between CPU and motherboard architecture. Hopefully Intel can pull itself out of this downfall sooner rather than later.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards