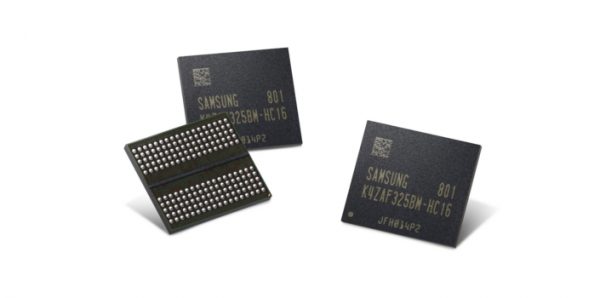

RAM prices have risen significantly over the last couple of years and while things are starting to settle down a bit now, there are still many who believe that something shady was going on. In December 2017, China's economic regulator began investigating Samsung, SK Hynix and Micron in order to figure out whether or not the three companies had colluded in a price fixing scheme. Since then, investigators have apparently uncovered “massive evidence” against the three companies.

When market share is combined, Samsung, SK Hynix and Micron control the overwhelming majority of the DRAM market (over 90%). If China's investigation finds the company's involved guilty, then hefty fines could be imposed, ranging anywhere from $800 million to $8 billion. The investigation in China isn't the only legal issue though, there is also a class action lawsuit out against Samsung, SK Hynix and Micron over in the US, which also claims that the three companies colluded to inflate prices.

Speaking with The Financial Times, China's anti-monopoly bureau head, Wu Zenghou, noted that the DRAM price fixing investigation has “made important progress”. He also added that “massive evidence” of anti-competitive behaviour has been uncovered, although specific examples weren't given.

Of course, this could all just end up being another ugly side to the on-going chip war. Just recently, the US accused a China-based semiconductor of stealing trade secrets from Micron. Before that, multiple people were arrested for attempting to steal trade secrets from TSMC, with the goal of selling them to companies in China.

KitGuru Says: We don't really have enough information to lean one way or the other at the moment. Still, it will be interesting to see where things go from here.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards