How Mining and Blockchain Fit Together

The word “blockchain” has become synonymous with cryptocurrency, but in fact this is just one part of the system. The blockchain is the ledger, equivalent to the database of value held and transactions completed that we talked about earlier in this feature. The big difference is that, whereas the primary function of traditional banks is keeping their ledgers secret and hidden, the blockchain is meant to be entirely public. The fact that it is all over the place and cryptographically signed gives it security from cheating, at least in theory, although later in this feature we will discuss some of the problems with this configuration.

The concept of the blockchain was created by the mysterious Satoshi Nakamoto, the father of Bitcoin (or it could be mother or even parents, because nobody knows who Satoshi Nakamoto is). As the word “blockchain” implies, it’s a chain of blocks, and each block contains a bundle of transactions, depending on the size required per transaction and the size of a block. For Bitcoin, a transaction takes about 495 Bytes, and a block is 1Mbyte, so it contains up to 2,020 transactions. But other cryptocurrencies use different block and transaction sizes.

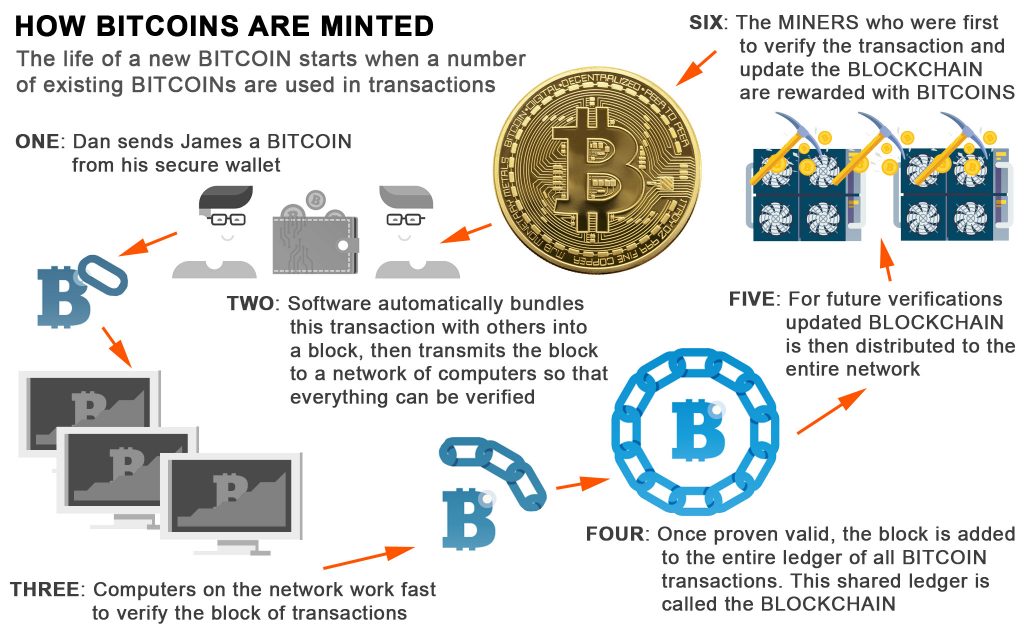

In order to add a new block of transactions to the blockchain, all the transactions contained within it need to be confirmed. This is what cryptocurrency miners do. They perform a cryptographic function to find a hash that connects the new block to its predecessor in the blockchain. In Bitcoin, this is based on the SHA 256 Hash algorithm, but other cryptocurrencies use different algorithms.

Mining is competitive, with miners vying to be first to find the hash for a given block. If they are first, they are rewarded with a newly minted piece of cryptocurrency. Apart from when a new cryptocurrency is first launched, this is the only way to mint new coins, which is how the supply is limited. Since miners actually have to perform some computing work, this keeps a check on any organisation simply pumping currency into the system. However, it doesn’t stop economies of scale in mining via computing farms, but it will prevent complete monopolisation.

In other words, a cryptocurrency is distributed in two main ways. A distributed network of peers holds copies of the blockchain, and you could even keep a copy on your own computer, becoming part of this network. A distributed network of peers also performs the mining that verifies transactions and adds new blocks to the chain and mints new currency in the process. This means that the minting is distributed too.

Although most cryptocurrency systems have this same basic structure, there are now lots of them with subtly different characteristics. So next we will turn to an overview of Bitcoin, Ethereum, Ripple, Dogecoin, and the market-leading alternatives that now exist in the fascinating and ever-expanding world of blockchain.

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards

KitGuru KitGuru.net – Tech News | Hardware News | Hardware Reviews | IOS | Mobile | Gaming | Graphics Cards